The Rise of Seller-Fulfilled Prime: The past year revealed an increase in Amazon retailers using Seller-Fulfilled Prime, many of which are FBA sellers switching their fulfillment method to SFP or using a combination of FBA & SFP for a variety of reasons.

The Product Avalabilty Variable: A new, high impact addition to the list of variables that affect the Buy Box. Backordered items can in fact win the Buy Box Bible and we dive into this further.

New Buy Box Statistics: An 8% increase in competition on Amazon versus last year, which means that more sellers are changing prices more frequently. We unveil more specific Buy Box statistics inside.

What is the BuyBox?

There are Two Types of Sellers on Amazon:

Amazon itself that sells a vast range of products, and third-party sellers who utilize the Amazon website as a platform to sell their own products. As there is no limit on the number of sellers or the number of products that they can offer, the same product is often sold by many sellers, each competing for the maximum number of sales. When a customer lands on a product detail page, amazon chooses one.

seller whose details appear in the buy box—the white box on the right-hand side of the page. when a customer clicks on the “add to cart” button, the sale goes to the seller in this box.This seller, called the Buy Box “winner,” will make far more sales than any other seller for that product. The importance of this prime online space and how it can be won by any third-party seller is the subject of this book. All third

-party sellers hope to see their products appear in the illustrious amazon buy box.

How Important is The Buy Box?

When Amazon first opened its online doors in 1995, no one could have predicted just how large the e Commerce giant would become. In 2017, $178 billion of revenue went through amazon.com alone, making it the largest e-retailer in the United States, responsible for more than half of e Commerce growth. Out of this $178 billion, an estimated $142 billions of sales went through the buy box, with almost half going straight into the pockets of third-party amazon marketplace sellers a product with the buy box will sell four times more than the same product without the buy box.

The Sky is The Limit!

With third-party sales set to grow even more in 2023, the Buy Box itself is the single largest revenue-generating opportunity for online marketplace sellers today. Understanding how the Buy Box works, therefore, is critical for sellers who want to take advantage of this potentially massive market. Understanding how the Buy Box works, therefore, is critical for sellers who want to take advantage of this potentially massive market.

Over 80% of Amazon website sales today go through the Buy Box, and this number greatly increases with Amazon mobile sales. It is vital for sellers to understand how Amazon determines who acquires this coveted spot, as it can really make or break an online business. This extensive guide does not attempt to teach sellers how to “beat” the Buy Box or reverse engineer its calculations. Rather, it provides sellers with all the information they need to successfully “work with” the Buy Box, taking advantage of Amazon’s own algorithms to increase sales, maximize profit margins, and outperform the competition.

BuyBox Misconception and Myths

Lowest Price Point Manipulations

- This theory claims that a seller who undercuts the lowest competition by a certain percentage and then takes off an extra penny will always win the Buy Box. After testing this theory extensively with multiple products, at multiple price points, and in multiple categories, it is evident that this is not a fixed rule. The idea may have gained popularity because when it was tested on low end products, it created a lot of false positives.

- Although lowering prices always increases one’s chances of winning the Buy Box, as will be discussed, the claim that a certain equation will guarantee the Buy Box certainly holds no truth. Continually lowering the price creates price wars between sellers, driving down profit margins on all sides.

The 2% Rotation Rule

- Another false assumption is that if a seller’s price is within 2% of the current Buy Box winner, that seller is guaranteed to win the Buy Box at least certain percentage of the time, as the Buy Box rotates between sellers.

- Again, there is no evidence to support this theory. Although it does often work when tested, this is another example of false positives. Buy Box rotations do exist, but this has nothing to do with “the 2% rule.

- Although it would be great if there were proven shortcuts to winning the buy box, unfortunately, there are none.

How the Buybox Works

Amazon’s goal has always been to offer the best possible experience to its customers. The Buy Box was created with the objective of comparing multiple offerings of the same product, in order to determine which will give the customer the highest level of satisfaction.

When determining which product offering will win the Buy Box, the algorithm first determines which of the competing offerings meet all the necessary minimum requirements. It then breaks down each eligible offering into many different variables and evaluates each one relative to the other sellers offering the same product.

“To put it very simply, the amazon buy box is an algorithm that tries to give the customer the best possible value of money.

It does this by determining which product offering promises the best balance of high seller performance and low-cost price.”

Buy Box Rotations

Amazon has long abandoned the idea of giving the Buy Box to a single seller for very popular products. Instead, the Buy Box is shared between several sellers, with their “share” of the Buy Box determined by the variables mentioned below. For example, if there are ten perfectly equal sellers all competing for the same product Buy Box, they might get 10% each. This means that each seller’s offering will be shown in the buy box for 10% percent of each day.

- Alternatively, a relatively high performing seller could have 70% of the buy box, an average seller could have 25%, and a lower performing seller, 5%. Therefore, instead of saying that a seller wins or loses the buy box, the correct description is that a particular seller has a lesser or greater share of the buy box. It is important to note that buy box rotations do not always take place. When they do, they are often dependent on the product, the competition, and the time of day. Furthermore, these rotations are hidden from the customer, as amazon uses cookies to ensure each customer sees only one buy box winner per hour. However, if the buy box winner’s metrics change for whatever reason, such as the price of the product or the amount of available stock, amazon may rotate to another seller before the one-hour time period is up. These changes, however, are not instantaneous, and could take as long as 15 minutes to be updated.

Beating Amazon to the Buybox

- Sellers often ask why Amazon itself is always winning the Buy Box, and if it is possible to ever beat it to that most sought-after position. The Buy Box treats Amazon as a seller with perfect Customer experience metrics. Therefore, if a merchant has near perfect customer metrics, or a very low landed price, that seller will often share the buy box with amazon, or beat it straight out, if the price is low enough. It used to be that the one big exception to this was with regard to specific media categories.

When No Seller Qualifies for the BuyBox

There are two instances in which no seller will win the Buy Box. In these cases, the Buy Box will show a ‘See All Buying. Options’ button, and the buyer will be taken to the Offer Listing page (also known as the ‘More Buying Choices’ page), which lists all merchants who sell this product in order of Landed Price only.

Instances are Listed Below

- When the sellers’ prices are deemed unreasonable because they are higher than the List Price. The List Price is the full retail price. Although there has been an overall increase in competition on Amazon, the number of sellers specifically competing for the Buy Box has decreased on average by 10% versus last year (in part due to the increase in private label products). This means that if sellers play their cards right, they have more opportunity to capitalize on gaining Buy Box share. When competing for the Buy Box, the seller has to first meet the four key criteria listed below:

Buy Box Requirements

- Only sellers paying Amazon the monthly fee for a

Professional Seller account (known as a Pro-Merchant account in the UK and Europe) will be considered for the Buy Box.

- Individual Seller accounts (known as Basic accounts in the UK and Europe) cannot compete for the Buy Box.

BuyBox Eligibility (1)

- In order to win the Buy Box, a seller must be Buy

- Box-eligible for the product. This status is awarded to experienced Professional Seller account holders who have spent time selling on the Amazon platform. They must also possess high levels of performance.

How to Check the Buybox Eligibility

- Click on the Inventory tab in Amazon Seller Central and select Manage Inventory.

- Click on the Preferences tab.

- In the Column Display section, locate the field for Buy Box-eligible.

- Select “Show When Available” from the drop-down menu.

- Look at the Buy Box-eligible column for a particular SKU. If the seller is eligible, it will say “yes.” Please note that sellers may see that they are eligible to win the Buy Box for some products, but not for others.

- If a seller believes to have met all the required criteria and has not been awarded Buy Box-eligible status, the seller can contact Amazon seller support directly to request to be considered for this status.

BuyBox Eligibility (2)

- Although there has been an overall increase in

- Competition on Amazon, the number of sellers specifically competing for the Buy Box has decreased on average by 10% versus last year (in part due to the increase in private label products). This means that if sellers play their cards right, they have more opportunity to capitalize on gaining Buy Box share.

- When competing for the Buy Box, the seller has to first meet the four key criteria listed below.

BuyBox Eligibility (A) Professional Seller Account

- Only sellers paying Amazon the monthly fee for a

- Professional Seller account (known as a Pro-Merchant Account in the UK and Europe) will be considered for the Buy Box.

- Individual Seller accounts (known as Basic accounts in the UK and Europe) cannot compete for the Buy Box.

BuyBox Eligibility (B) Professional Seller Account

In order to win the Buy Box, a seller must be Buy:

- Box-eligible for the product. This status is awarded to experienced Professional Seller account holders who have spent time selling on the Amazon platform.

- Also possess high levels of performance.

To Check Buybox Eligibility

- Click on the Inventory tab in Amazon Seller Central

- And select Manage Inventory.

- Click on the Preferences tab.

- In the Column Display section, locate the field for Buy Box-eligible.

- Select “Show When Available” from the drop-down menu.

- Look at the Buy Box-eligible column for a particular SKU. If the seller is eligible, it will say “yes.”

- Please note that sellers may see that they are eligible to win the Buy Box for some products, but not for others.

- If a seller believes to have met all the required criteria and has not been awarded Buy Box-eligible status, the seller can contact Amazon seller support directly to request to be considered for this status.

“In Order to Be the Running for the Buybox, a Seller needs to Fulfill Certain Criteria.”

Secondary to the Buybox

Amazon Mobile Buybox

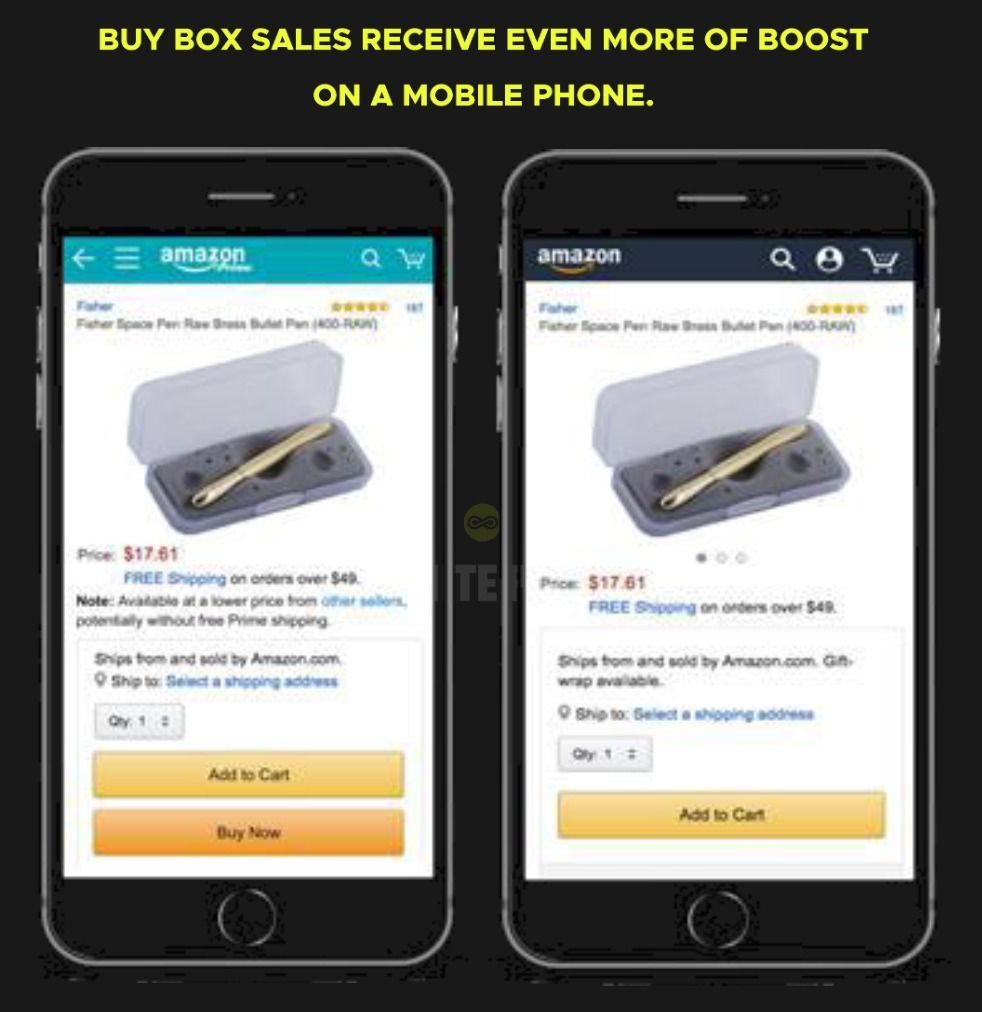

- Amazon mobile shopping is steadily on the rise. Amazon reported that during the 2017 holiday period, customers shopped on the Amazon mobile app nearly 70% more than last year, purchasing at extremely high frequencies. The Amazon app is free for most mobile devices and its look and feel is similar to their main sites.

- The role that the mobile Buy Box plays is absolutely crucial.

- On a desktop, laptop, or tablet, all the product information appears on one page. To purchase a particular product, buyers will either go straight to the Buy Box, choose a seller from the Other Sellers on Amazon box, or click on the link that will take them to all sellers’ offerings on the Offer Listing Page.

- On both Amazon mobile and the Amazon app, however, the customer has to scroll down a vertical chain of information, and the Buy Box appears directly beneath the product image and price.

- The “Add to Cart” button appears prominently on the app and mobile; on the app, the customer also has the option to “Buy Now.” If you like what you see, there is no reason to scroll down any further.

- In addition, no “Other Sellers on Amazon” box exists on Amazon’s mobile and app versions. On the app (top left), the link to all sellers’ offerings appears before the Buy Box but since it’s not in a box, it’s easy to miss. On Amazon mobile (top right), the link —which doesn’t mention other sellers at all—appears under the Buy Box, so many customers likely don’t even see it.

BuyBox Requirements

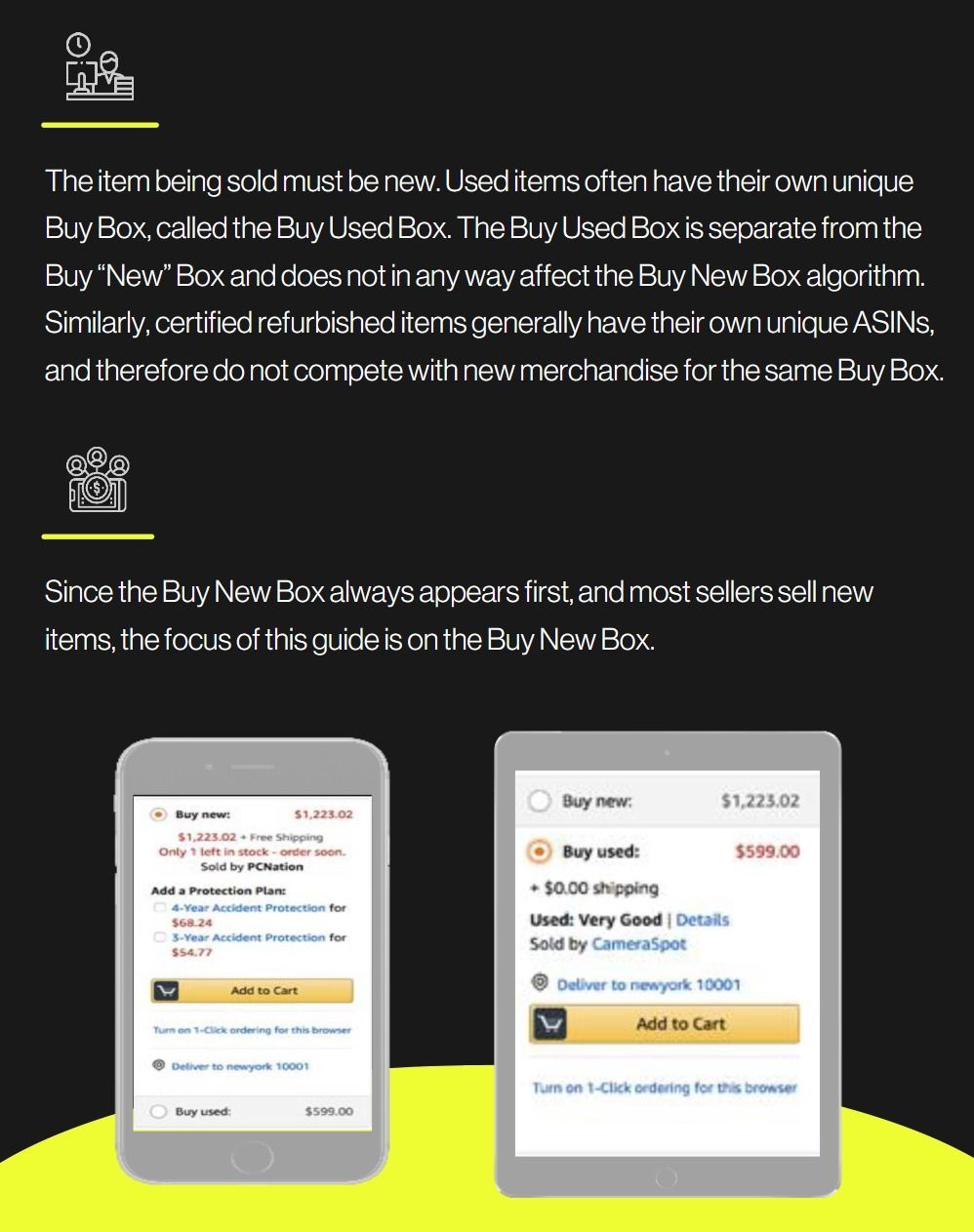

The item being sold must be new. Used items often have their own unique Buy Box, called the Buy Used Box. The Buy Used Box is separate from the Buy “New” Box and does not in any way affect the Buy New Box algorithm. Similarly certified refurbished items generally have

their own unique ASINs, and therefore do not compete with new merchandise for the same Buy Box.

Since the Buy New Box always appears first, and most sellers sell new items, the focus of this guide is on the Buy New Box.

Used Items

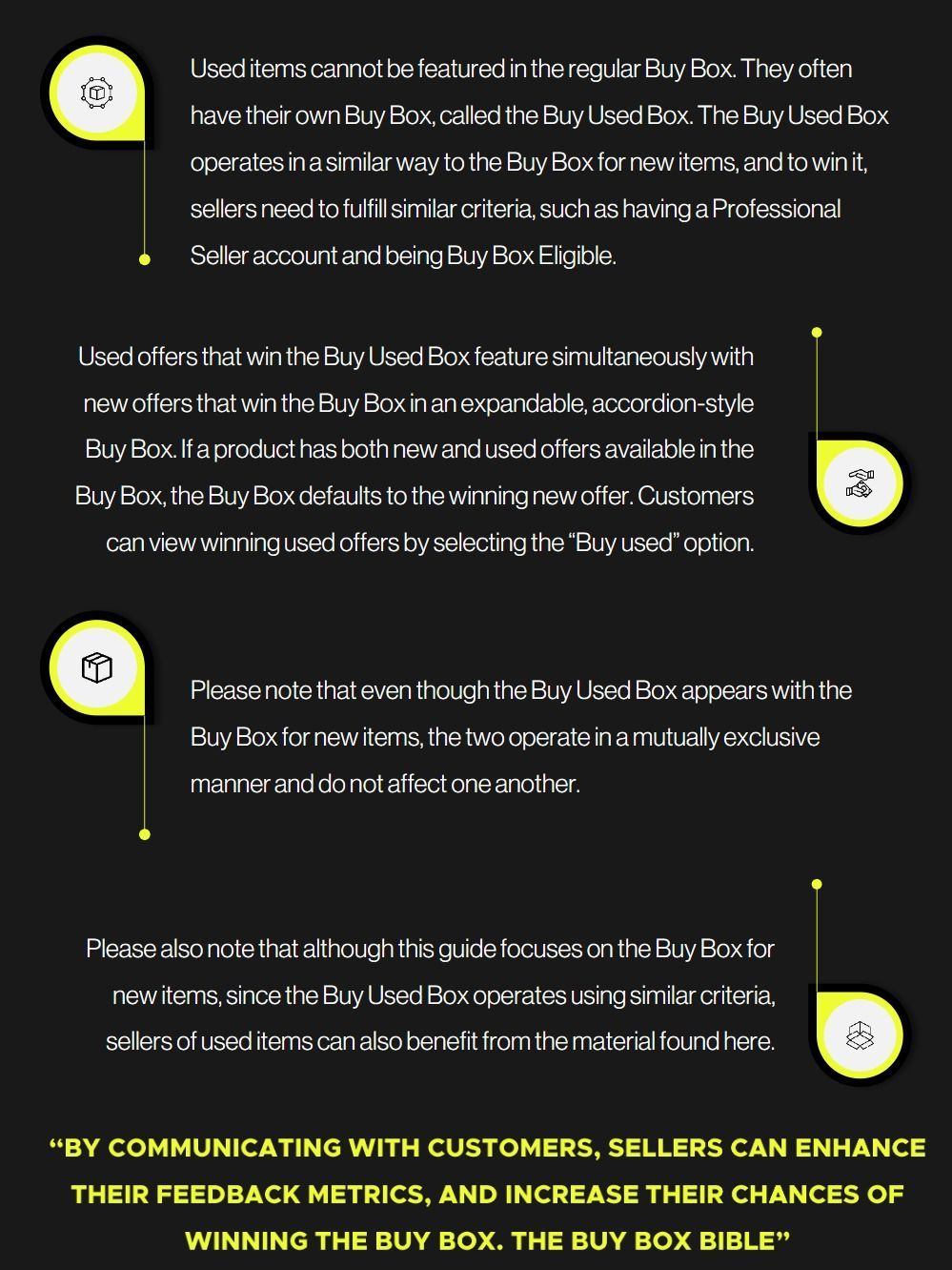

- Used items cannot be featured in the regular Buy Box. They often have their own Buy Box, called the Buy Used Box. The Buy Used Box operates in a similar way to the Buy Box for new items, and to win it, sellers need to fulfill similar criteria, such as having a Professional Seller account and being Buy Box Eligible.

- Used offers that win the Buy Used Box feature simultaneously with new offers that win the Buy Box in an expandable, accordion-style Buy Box. If a product has both new and used offers available in the Buy Box, the Buy Box defaults to the winning new offer. Customers can view winning used offers by selecting the “Buy used” option.

- Used offers that win the Buy Used Box feature simultaneously with new offers that win the Buy Box in an expandable, accordion-style Buy Box. If a product has both new and used offers available in the Buy Box, the Buy Box defaults to the winning new offer. Customers can view winning used offers by selecting the “Buy used” option.

- Please also note that although this guide focuses on the Buy Box for new items, since the Buy Used Box operates using similar criteria, sellers of used items can also benefit from the material found here.

“By communicating with customers, sellers can enhance their feedback metrics, and

increase their chances of winning the buy box. The Buybox bible.”

Second to the Buybox

Other Sellers on Amazon:

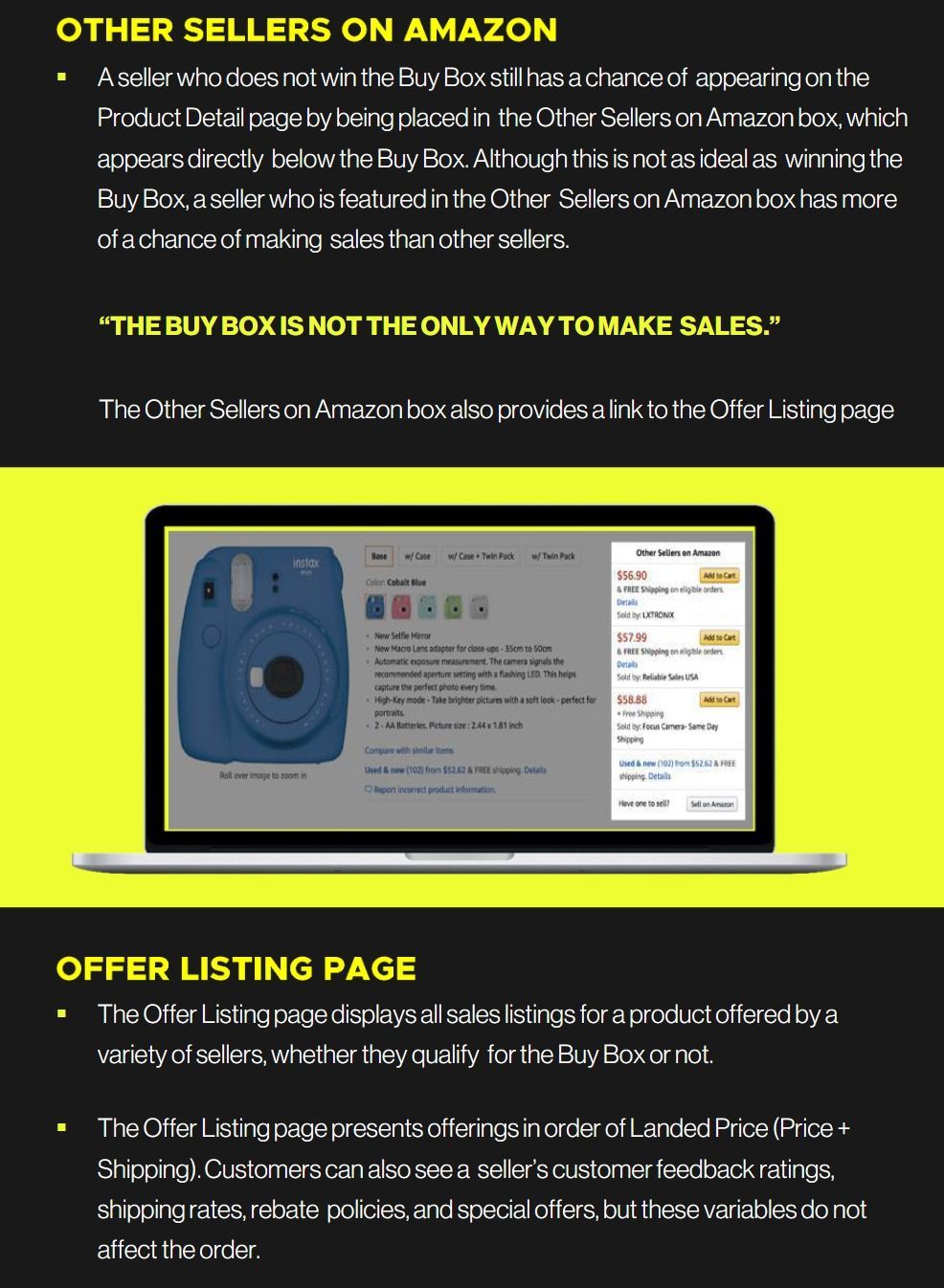

A seller who does not win the Buy Box still has a chance of appearing on the Product Detail page by being placed in the Other Sellers on Amazon box, which appears directly below the Buy Box. Although this is not as ideal as winning the Buy Box, a seller who is featured in the Other Sellers on Amazon box has more of a chance of making sales than other sellers.

The Buybox is NOT the only way to make sells:

Offer Listing Page:

- The Offer Listing page displays all sales listings for a product offered by a variety of sellers, whether they qualify for the Buy Box or not.

- The Offer Listing page presents offerings in order of Landed Price (Price + Shipping). Customers can also see a seller’s customer feedback ratings, shipping rates, rebate policies, and special offers, but these variables do not affect the order.

Amazon Mobile Buybox

- Amazon mobile shopping is steadily on the rise. Amazon reported that during the 2017 holiday period, customers shopped on the Amazon mobile app nearly 70% more than last year, purchasing at extremely high frequencies. The Amazon app is free for most mobile devices and its look and feel is similar to their main sites.

- The role that the mobile Buy Box plays is absolutely crucial. On a desktop, laptop, or tablet, all the product information appears on one page. To purchase a particular product, buyers will either go straight to the Buy Box, choose a seller from the Other Sellers on Amazon box, or click on the link that will take them to all sellers’ offerings on the Offer Listing Page.

- On both Amazon mobile and the Amazon app, however, the customer has to scroll down a vertical chain of information, and the Buy Box appears directly beneath the product image and price.

- The “Add to Cart” button appears prominently on the app and mobile; on the app, the customer also has the option to “Buy Now.” If you like what you see, there is no reason to scroll down any further. In addition, no “Other Sellers on Amazon” box exists on Amazon’s mobile and app versions. On the app (top left), the link to all sellers’ offerings appears before the Buy Box, but since it’s not in a box, it’s easy to miss. On Amazon mobile (top right), the link —which doesn’t mention other sellers at all —appears under the Buy Box, so many customers likely don’t even see it.

- For these reasons, mobile shoppers are much more likely to buy from the Buy Box, and sellers who don’t win this coveted spot are at a major disadvantage.

Variables that Effect the Buybox

- Once product eligibility has been determined, Amazon then compares multiple variables of each offering to determine which provides the best overall value to the customer. The weights assigned to each variable can change on a product-to-product or a category-to-category basis, so even though a seller could be losing to a competitor on one product, the same seller could be beating that same competitor on another unrelated product. It is vital to remember that all variables are measured relative to their competitors’ offerings.

For example:

Having an on-time delivery score of 98% could have a negative effect on winning the Buy Box if a near identical seller has a 99% rating. However, the chances of winning the Buy Box would increase if the seller was competing against someone with a 96% rating.

“Amazon considers many different factors in determining who wins the buybox.

The importance of each variable can change according to the product.”

Fulfillment Method: Fulfilment by Amazon (FBA)

- The most important variable considered by Amazon is the item’s fulfillment. Amazon considers its own fulfillment service to have perfect scores for multiple variables, including Shipping Time, On

- Time Delivery Rate, and Inventory Depth. Until recently, it was much more likely for merchants who use FBA to win the Buy Box. Although Fulfillment by Merchant (FBM) could still beat an FBA seller to the Buy Box doing so would require high relative scores in all areas and/or a very low price.

- For this reason, fba has always been the quickest and easiest way to drastically improve one’s chances of winning the buy box. Ultimately, though, this has to be a strategic business decision for the seller, as it has many other implications and can significantly eat into the seller’s overall profit margin if the decision has not been meticulously thought through and planned properly. When a product is Fulfilled by Amazon, it appears on the Offer Listing, Page as follows.

Fulfillment Method: Seller-Fulfilled Prime

- With Seller-Fulfilled Prime, high-performing Fulfillment by Merchant (FBM) sellers have the option of fulfilling orders with the same benefits of Amazon Prime.

- The FBM seller gains many advantages by using this fulfillment method. For one, Seller-Fulfilled Prime allows sellers to list their products as Prime-eligible —and reach a far larger audience —while maintaining control of their fulfillment operations. This is especially useful for sellers of large or heavy products, since using FBA requires them to pay an additional cost of shipping the products to an Amazon fulfillment center. By eliminating these shipping and handling fees as well as FBA long-term storage fees and shipping directly to the consumer, sellers are able to offer lower prices, or increase their margins on these products. They can also use the MWS Buy Shipping API to postage their shipping through Amazon, which gives them access to Amazon’s negotiated rates and service levels.

- Due to the cost savings associated with converting to SFP, the competitive landscape and how sellers compete and win the Buy Box is shifting. Customers have a higher tendency to pay more to a Prime badge owner and with that badge, sellers in turn have more of a chance to win the Buy Box.

- Interestingly, sellers can regionally designate where they would like to engage in SFP, allowing them to be Prime in the specific areas that make geographical sense for their Not every FBM seller may participate in Seller-Fulfilled Prime. Only those who have proven their ability to meet Prime customers’ expectations for service are eligible. Therefore, any seller who is interested in this program must have strong metrics across the board to begin with. Not every FBM seller may participate in Seller-Fulfilled Prime. Only those who have proven their ability to meet Prime customers’ expectations for service are eligible. Therefore, any seller who is interested in this program must have strong metrics across the board to begin with.

Landed Price

This includes shipping in the United States, and shipping and VAT in the UK and Europe. A lower Landed Price will increase the seller’s Buy Box share. This is arguably the easiest variable to manipulate, as it is the only element that the seller can control directly and instantly.

“The landed price is the total amount that the product is sold for on Amazon.”

The seller’s overall performance metrics are inferior to those of the competition, then the seller will need to lower the price of the product to gain a greater share of the Buy Box. The lower these metrics are, relative to the competing sellers, the lower the seller needs to drop the price in order to compete for the Buy Box.

“Conversely, the higher the seller’s performance metrics are in relation to the competition for a specific product,

the higher the price may be raised while still holding on to a healthy share of the buybox.

Price is certainly key to winning the buybox, however, on its own, it is not enough.”

This can be seen as the “dollar value” of improving customer experience. A higher Seller Rating and lower Order Defect Rate means the higher cost and maintain the same share of the Buy Box. A product’s Landed Price can be seen on the Amazon product page as follows:

Shipping Time

The simplest metric looked at by the Buy Box is the time in which the seller promises to ship the item to the customer for certain time-sensitive products and categories, such as birthday cards and perishable goods, the impact of this metric on the Buy Box will be even higher, since customers often demand swift shipping on such items. Shipping Time is arranged into several brackets.

These are:

0–2 days 3–7 days 8–13-day 14+ days

Please note that the term “days” refers to business days and does not include Saturdays or Sundays.

Again, jumping between the brackets will have a greater significance than moving within them. For example, sellers who improve their Shipping Time from six days to three days may see an increase in their Buy Box share. However, improving it from three days to two days will have a much greater effect.

“A product’s shipping time is reflected in the time the item is promised to arrive to the buyer.

It can be seen on the offer listing page as follows.”

Availability

- There must be available stock of the item the seller is trying to sell. Typically, if the item is not in stock, the seller cannot win the Buy Box. The Buy Box will not show “out of stock,” it will just rotate the position to another seller. It important to use inventory best planning practices to keep popular products in stock However, there is one exception to this rule, which is for a backordered item. Today, most products can be listed as “backordered,” with a note that is visible in the product page. even though the product is not yet fulfilled able and will only be shipped at a later date. Customers will see that the item is not available for shipping until the restock date as appears on Amazon.

- With a backorder, the seller will accept orders for the item, even though the product is not yet fulfilled able and will only be shipped at a later date. Customers will see that the item is not available for shipping until the restock date as appears on Amazon.

- For items that are FBA, there are a couple of reasons Amazon may decide to backorder an item, something that happened quite frequently in 2017. First, they want to minimize the chances of a buyer clicking on an ASIN and not seeing a Prime option available, even if the only Prime offer is backordered.

“This theory aligns with the fact that 85% of prime shoppers visit Amazon at least

once a week, so Amazon wants to make sure that.”

Secondly, more competition for the Buy Box keeps prices low which makes sense for Amazon to be conscious of. In conclusion, backordered items can be featured in the Buy Box, but items that are immediately fulfill able are favored so avoiding backorders should be a priority for all sellers.

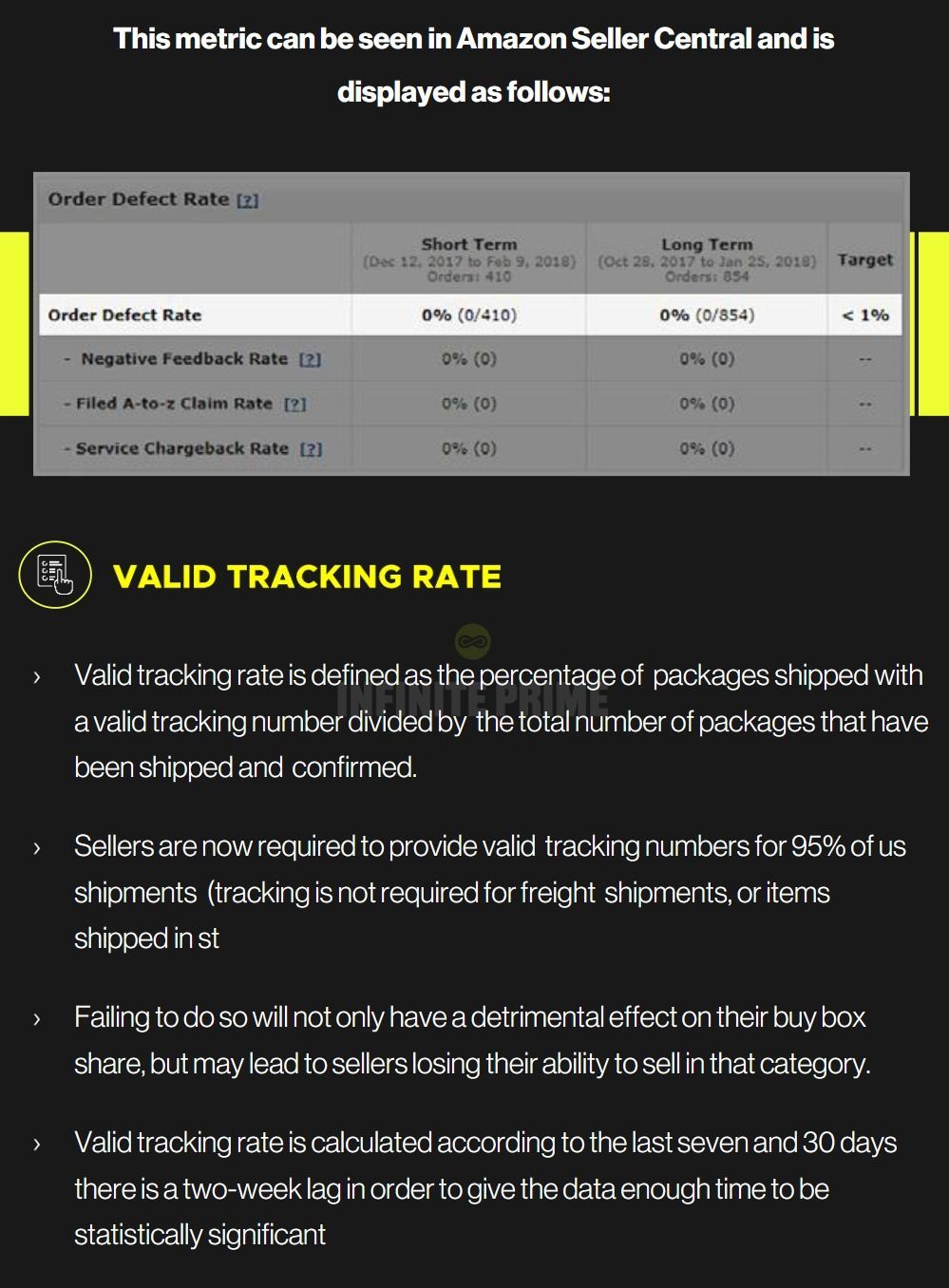

Order Defect Rate

The order defect rate (ODR) is a combination of three different metrics:

- The Negative Feedback Rate

- The A-to-Z Guarantee Claim Rate

- The Service Chargeback Rate

Amazon adds these three numbers together to work out the percentage of the defective orders that were sent. It groups these orders into two categories, “Short Term”. Those orders placed between one and two months ago, and “Long Term” —those placed between one and four months ago. Orders placed in the last 17 days are disregarded, as not enough time has elapsed to gather enough customer complaints.

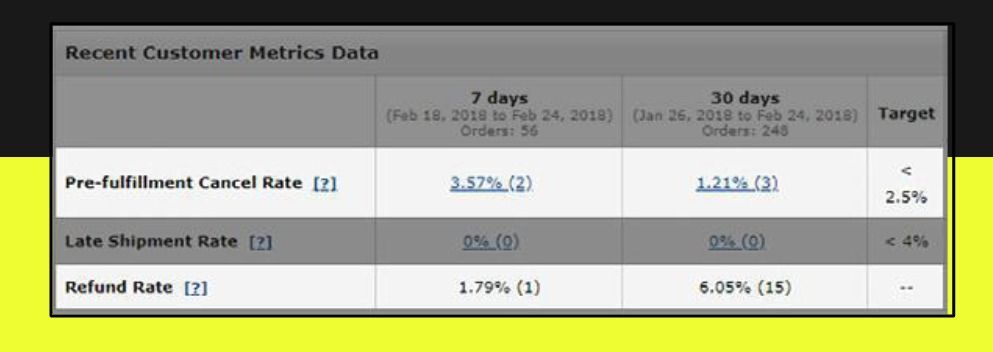

Late Shipment Rate

- Late Shipment Rate is the number of orders shipped later than the expected ship date.

- The expected ship date is calculated based on the handling time you set in Seller Central (in the Manage your Inventory section). If you do not set a handling time, the default is one to two business days. It is recommended, therefore, to ship and confirm shipment by the expected ship date.

- Ideally, this number should be kept below 4% in order to positively impact one’s chances of winning the Buy Box. This metric is grouped according to the last seven days and 30 days.

“Shipping a product later than promised will lead to unhappy customers who are expecting their order by a specific date.”

On-Time Delivery

This is the percentage of orders that buyers received by the estimated delivery date. This number is based on valid tracking information. A score of less than 97% will have a strong negative effect on the Buy Box. To calculate this percentage, the number of tracked packages that were delivered on time is divided by the number of packages that have valid tracking information.

Variables That Effect the Buybox

- This metric is grouped according to the last seven and 30days. There is a two-week lag in order to give the data enough time to be statistically significant.

- This is the culmination of all of the feedback that a seller has received from customers and is grouped by the last 30 days, 90 days, 365 days, and Lifetime.

“The most recent feedback has the greatest effect in the Buybox.”

In the below example, the 30-day feedback score was 94%, giving the seller 4.8 stars out of a maximum of 5 stars. This metric can be seen in Amazon Seller Central and is displayed as follows:

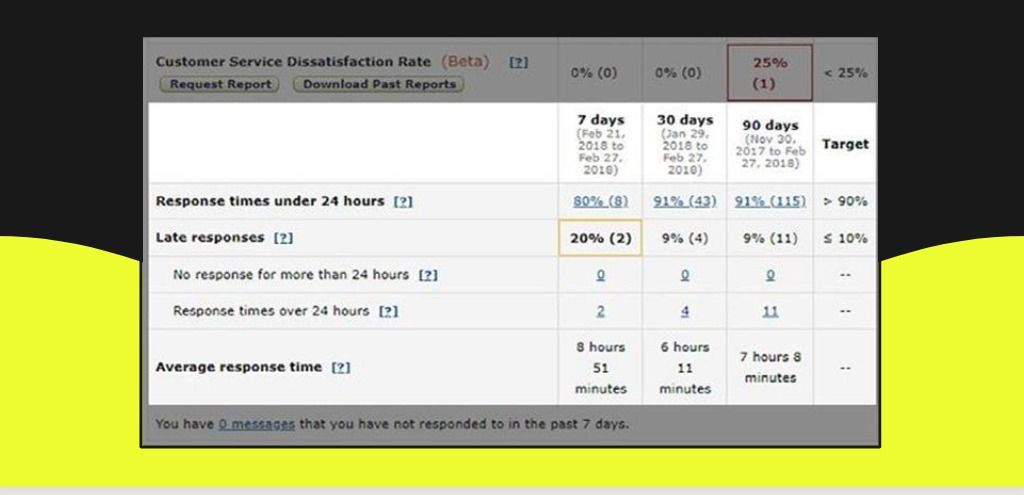

Customer Response Time

While initially believed to have little effect on the Buy Box, it is now evident that Customer Response Time plays apart in determining the Buy Box share. Amazon looks at this metric in two ways. First, it checks the average response time for the last seven, 30, and 90 days, and compares these times to competing sellers. It then also creates four brackets for messages received in these time periods, and groups them by their reply to times as follows:

“If over 10% of messages were replied to after 24 hours, or never replied to, the chances of the

seller winning the buy box will severely decrease.”

It is important to note that responses to every customer message (even customer replies) are included in these statistics, so it is important to respond to each one. Any auto replies sent are not counted as responses but checking the “Mark as no response needed” box in the reply to area within 24 hours will discount this message from the total metric, having neither a positive nor negative effect.

This metric can be seen in Amazon Seller Central and is displayed as follows:

Feedback Count

This is the total number of buyers that have given the seller feedback. This metric has a dual purpose. First, it is used to accurately weigh the Feedback Score between sellers with a long history and a lot of feedback, and newer sellers with a short history and less feedback. It is also considered a key metric in and of itself, and sellers with a high score are more likely to win the Buy Box over a seller with a low score, all other metrics being equal. This metric can be seen in Amazon Seller Central and is displayed as follows:

Inventory Depth and Sales Volume

- Amazon prefers to give the Buy Box to sellers who have enough inventory to deal with the increased demand that the Buy Box may create .For that reason, sellers with a larger current inventory, consistent sales, and a strong stock history may be granted a greater Buy Box share.

- The strength of the stock history is determined by how much time in the last 30 and 90 days the seller has been out of stock of this item. However, historical stock amounts do not seem to be taken into account. Even if a seller maintains a low stock level, they will be preferred over a perfectly equal competitive seller who has frequent fluctuations in stock quantity and often goes out of stock.

- These metrics have not been proven to have a strong effect on the Buy Box when compared to other, higher-impact metrics. They may be used to distinguish between sellers who have very similar performance ratings, and/or are bidding on very popular products, although we have not seen any strong proof of this. This metric is hidden and cannot be seen in Amazon Seller Central. This metric is hidden and cannot be seen in Amazon Seller Central

Cancellation and Refund Rate

This is the number of orders canceled by the seller prefulfillment, and the number of orders refunded to the customer post-fulfillment. While a positive score does not have a strong impact on the Buy Box share, a prefulfillment Cancellation Rate greater than 2.5% will have a strong negative effect. This metric can be seen in the Amazon Seller Central and is displayed as follows:

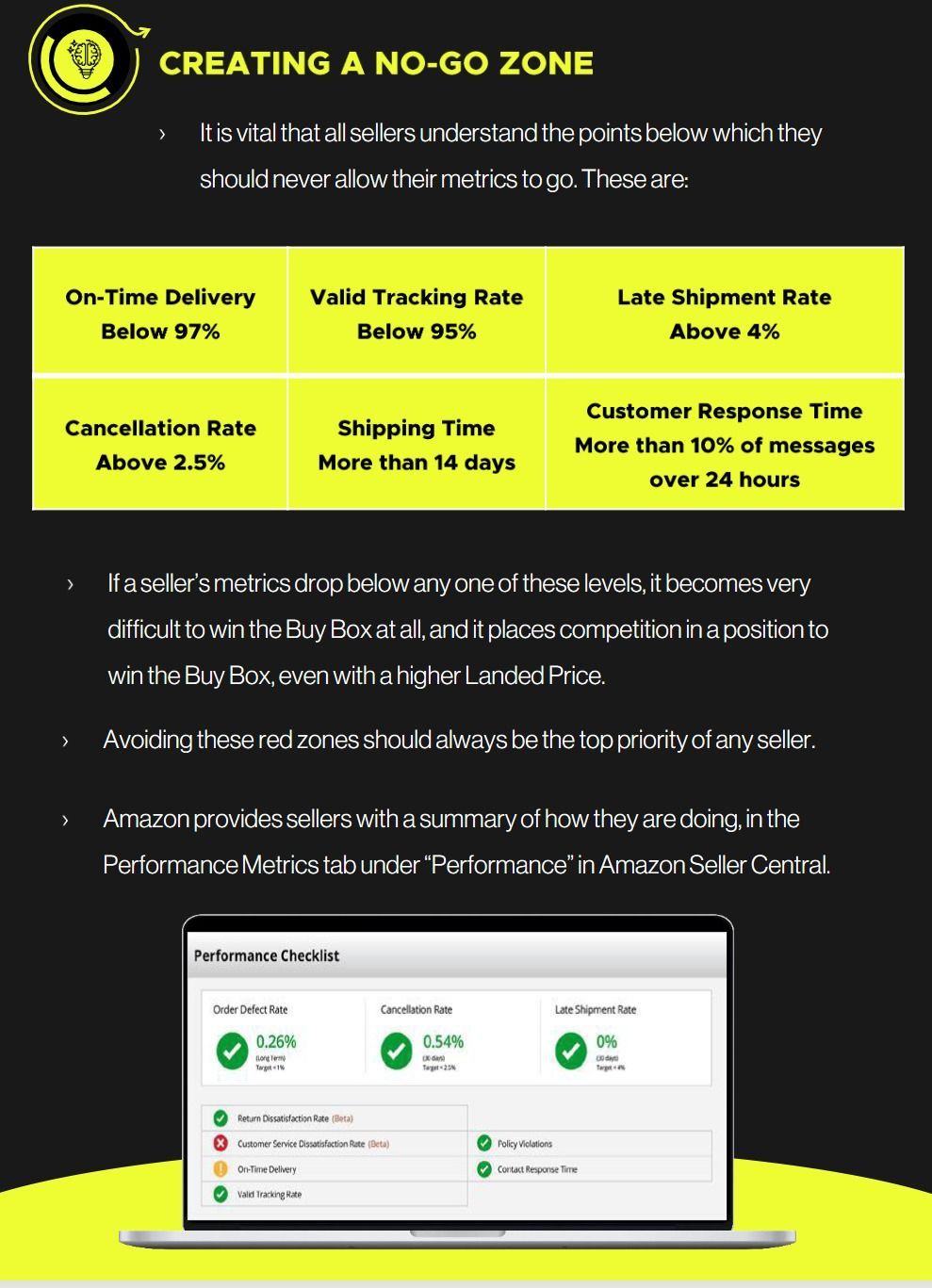

Variables that May Eventually Affect the BuyBox

- Amazon launched two metrics to help sellers gauge customer satisfaction with their service of return requests and responses in Buyer-

- Seller Messaging. These metrics are the Return Dissatisfaction Rate and the Customer Service Dissatisfaction Rate. Both of these metrics were created in order to help sellers understand possible issues that lead to a claim or negative feedback.Currently, there are no penalties for not meeting the performance targets for either of these metrics, and these metrics do not have any impact on a seller’s Buy Box share.

- However, Amazon has already warned sellers that they will give advance notice if anything changes, which hints at the strong possibility of this occurring at some point in the future. It is for this reason that we are mentioning these metrics and sellers should keep them in good health.

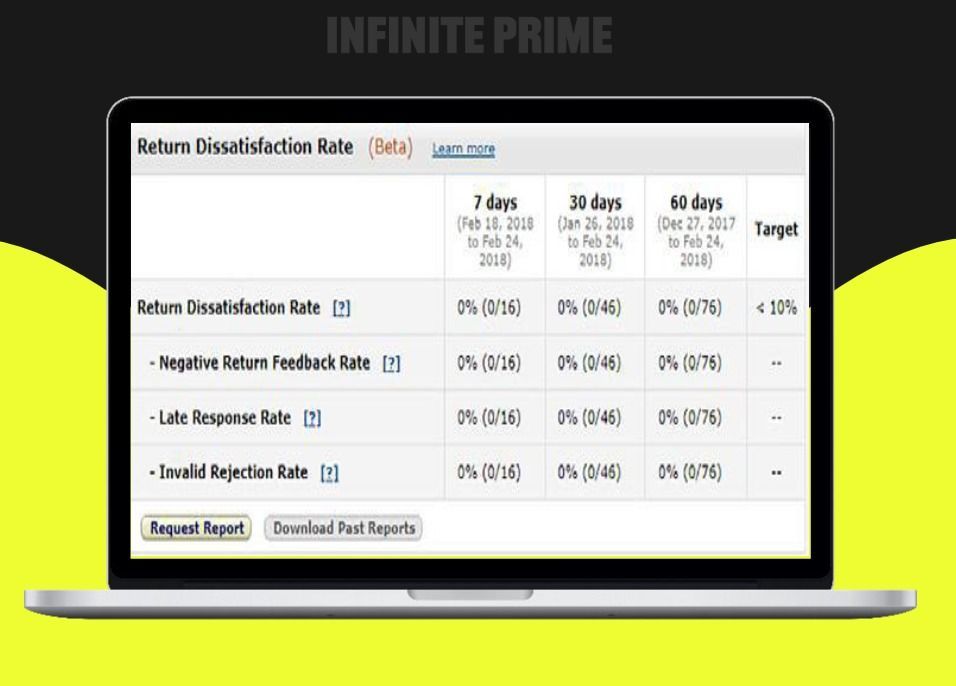

Return Dissatisfaction

The Return Dissatisfaction Rate is the percentage of valid return requests that were not answered within 48 hours, were incorrectly rejected, or received negative customer feedback. It is calculated according to the last seven days, 30 days, and 60 days. For every return request, Amazon asks buyers if their return was resolved. If they indicate that it wasn’t, the return request is considered to have negative feedback.

The Return Dissatisfaction Rate Consists of 3 Elements

- Negative Return Feedback Rate: the percentage of negative feedback that a seller received following a return request.

- Late Response Rate: the percentage of return requests from buyers that have not been answered within 48 hours.

- Invalid Rejection Rate: the percentage of in-policy return requests that are incorrectly rejected. If a return is in-policy, the buyer should receive a full refund, a request authorization, or a resolution of the issue so that the return is no longer desired.

- This metric can be seen in Amazon Seller Central and is displayed as follows:

Customer Service Dissatisfaction Rate is the percentage of customers who are not satisfied with the seller’s response in Buyer-Seller Messaging. When a seller responds to a buyer message about an order, Amazon includes a customer survey immediately below the response asking, “Did this solve your problem?” Buyers can respond “Yes” or “No.” Only a seller can see a buyer’s response. Customer Service Dissatisfaction Rate is the number of “No” votes divided by the total number of survey responses expressed as a percentage. Amazon only counts the latest survey vote for each order. If the seller addresses the problem and the buyer later changes the response to “Yes,” the previous “No” vote is discounted.

“Amazon recommends that sellers do not exceed a customer service dissatisfaction rate of 25%. The Buy Box Bible.”

Winning the Buy Box

- The key is to identify which changes would have the biggest effect on the Buy Box share, at the lowest business costs in terms of time, money, and manpower.The theory behind winning the greatest share of the Buy Box is simple: always improve on one or more of the aforementioned metrics without sacrificing performance in other areas. In reality though, it is not always that easy. Online businesses don’t have endless resources to put into customer service, nor are they willing to give up profit margins by lowering prices to win the Buy Box on Landed Price alone.

- As metrics are only appraised relative to other sellers of the same product, a seller with items in less volatile marketplaces where the competition hardly changes can take advantage of this relativity.

- A really good example of this can be seen with the Shipping Time metric. If a seller has a product that ships in two days, with competitors that ship the same product in 10 days, assuming all other metrics are comparable, this seller has a higher chance of getting a large Buy Box share. However, increasing the Shipping Time from two days to seven can still maintain the same Buy Box share.

- Meanwhile, if this same seller, then has another product that is shipped in five days, while competitors ship it in three, it might be worthwhile to spend the money saved on shipping costs from the previous product in order to reduce the Shipping Time for this product to two days. This is likely to give the seller a higher percentage of the Buy Box for both products.

Working on Feedback

- Two of the most difficult metrics for a seller to boost are Feedback Score and Feedback Count. The reason for this is that unlike other metrics which can be controlled by the seller, feedback relies entirely on the buyer taking action.

- Two of the most difficult metrics for a seller to boost are Feedback Score and Feedback Count. The reason for this is that unlike other metrics which can be controlled by the seller, feedback relies entirely on the buyer taking action.

- Sellers can encourage buyers to leave feedback in a number of ways. They can add a cute and quirky feedback request message to the packaging slip in the order.

- They can also contact the buyer directly, via the Contact Buyer link in the Manage Orders section of Seller Central. Alternatively, feedback tools are available to automatically send reminders to the buyer once a sale is complete.

- Newer sellers who do not yet have a lot of feedback can quickly and easily increase their Feedback Count by selling a couple of popular and cheap items. This will raise their chances of making more sales, which is likely to increase the number of customers who will leave feedback.

- Two of the most difficult metrics for a seller to boost are Feedback Score and Feedback Count. The reason for this is that unlike other metrics which can be controlled by the seller, feedback relies entirely on the buyer taking action.

- A seller should always try to work with the buyer to get negative feedback removed. This may require issuing a refund, sending a replacement item, or providing a complimentary gift certificate.

- Once the customer’s problem is resolved, the seller can request removal of the negative feedback.

- Working on feedback will not only impact a seller’s Feedback Score and Feedback Count, but it will also positively affect the Order Defect Rate metric.

“By communicating with customers, sellers can enhance their feedback metrics,

and increase their chances of winning the buybox.”

Optimizing Your Prices

- Changing the price of a product is the quickest and easiest way to manipulate the Buy Box. As stated, lowering the total price will almost always increase a seller’s chance of winning the Buy Box.

- A seller with customer performance metrics at least as good as the competition is far more likely to win the Buy Box with the low price. While this strategy often produces positive results, it has two major drawbacks.

- First, it ensures the minimum possible profits for the product. If, for example, the seller’s customer performance metrics are better than the lowest competitor, this product could be sold at a significantly higher price, and still maintain the same Buy Box share.

- More importantly, this technique creates endless price wars, with two or more sellers continuously dropping their prices to outmatch the other.

- This destroys profit margins and may end with all sellers selling at cost price, just to cover their expenses.

- We have seen a significant increase in price wars waged on Amazon, and that trend is likely to continue. This riisein price wars are a clear indication that winning the Buy Box has become even more competitive than ever before.

“The traditional “quick and dirty” method involves lowering one’s price to undercut the lowest competitor.”

Finding the Sweet Spot

When using pricing strategies to win the Buy Box, the seller has to carefully balance two separate quantities —the Buy Box share and the product’s profit margin.

“Having a low percentage of the Buy Box and high profit margins can be better than a

high percentage of the buy box and low profit margins.”

For example, if a seller currently has 70% of the Buy Box share with a $5 profit margin, it might be worth raising the price by a few dollars, even if the Buy Box share goes down to 60%. Finding this optimum point between the Buy Box share and profit margin will lead to the maximum contribution per product and ultimately the highest overall profits When using pricing strategies to win the Buy Box, the seller has to carefully balance two separate quantities —the Buy Box share and the product’s profit margin. There are three methods currently used by Amazon sellers to find this pricing sweet spout. These are manual, rule based, and algorithmic repricing.

Conclusion

- As you can see, the Amazon Buy Box is intricate and can certainly be difficult to understand without the proper educational resources. Although complex, once mastered, the Buy Box has the capacity to completely transform online retailers’ business success. The ball is in the seller’s court -it is their responsibility to keep a firm grip on the metrics that impact the Buy Box and make monitoring those metrics a part of their daily routine.

- Remaining customer-centric and providing five-star customer service allows sellers to raise their prices while simultaneously maintaining a healthy Buy Box share, which is ultimately a win for both the seller and the end-user.

- Arriving at that pricing “sweet spot” for every product in your assortment can be challenging but is a necessary step toward increased Buy Box share and maximized profits. Over time, finding the optimal price point will not only benefit your overall profits, but will empower you to continue to make strategic decisions that enhance your entire business. Happy Selling.

“Sellers have the power to continually win the Buy Box. All that is needed is Knowledge and Effort.”

Author and Creator: Dean Masalta

You don’t have to do it alone. We have a full-service Amazon growth team that can help you take advantage

of everything the retail giant offers its sellers.